As you approach retirement, it's essential to understand the rules surrounding your retirement accounts, particularly when it comes to required minimum distributions (RMDs). The Internal Revenue Service (IRS) provides worksheets to help you calculate your RMDs, ensuring you comply with tax regulations and avoid penalties. In this article, we'll delve into the world of RMD worksheets, exploring what they are, how to use them, and why they're crucial for your retirement planning.

What are Required Minimum Distributions (RMDs)?

RMDs are the minimum amounts you must withdraw from your retirement accounts, such as traditional IRAs, 401(k)s, and 403(b)s, each year after reaching age 72 (or 70 1/2 if you reached that age before January 1, 2020). These distributions are taxable, and the IRS requires you to take them to ensure that retirement accounts are used for their intended purpose: providing income in retirement.

Why are RMD Worksheets Important?

RMD worksheets are vital tools for calculating your annual RMDs. The IRS provides these worksheets to help you determine the correct amount to withdraw from your retirement accounts. By using these worksheets, you can:

Avoid penalties for not taking the required minimum distribution

Ensure you're taking the correct amount, neither too little nor too much

Plan your retirement income and taxes more effectively

How to Use RMD Worksheets

The IRS offers two main worksheets for calculating RMDs:

1.

Worksheet 1: Figuring Your Required Minimum Distribution for Each Account

2.

Worksheet 2: Figuring Your Required Minimum Distribution for Multiple Accounts

To use these worksheets, you'll need to gather the following information:

Your account balance(s) as of December 31st of the previous year

Your age as of December 31st of the current year

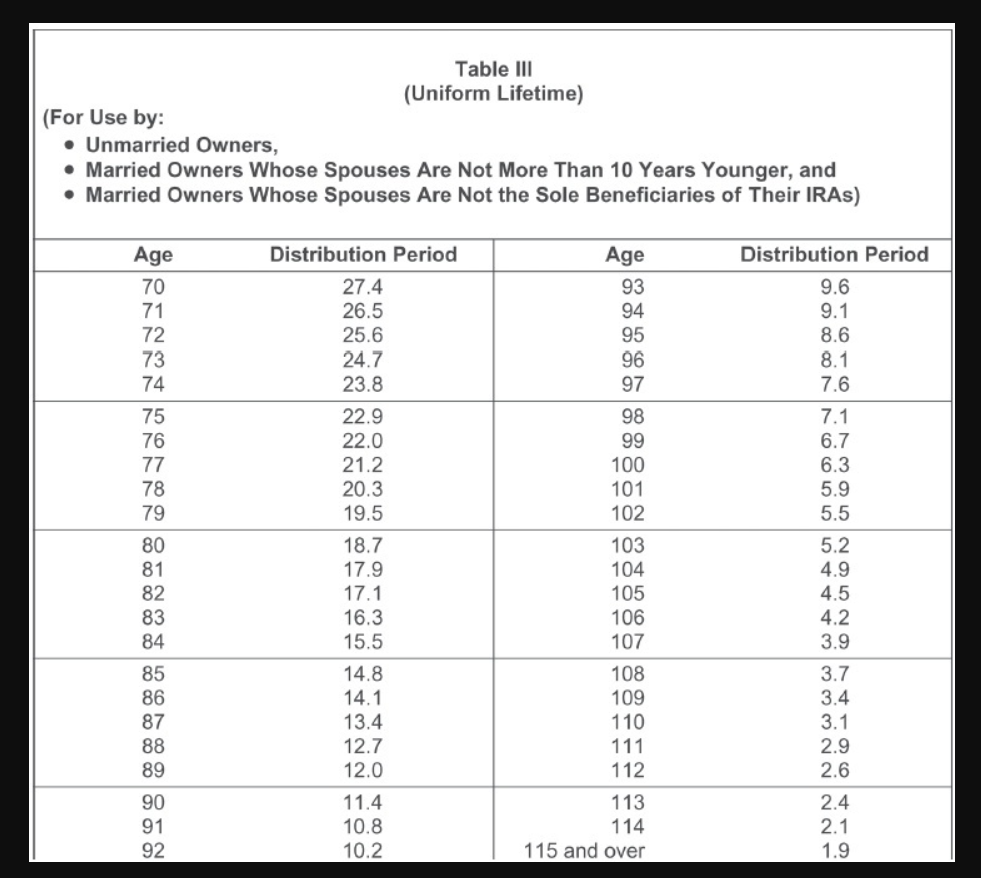

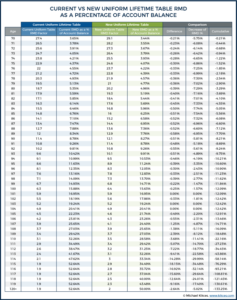

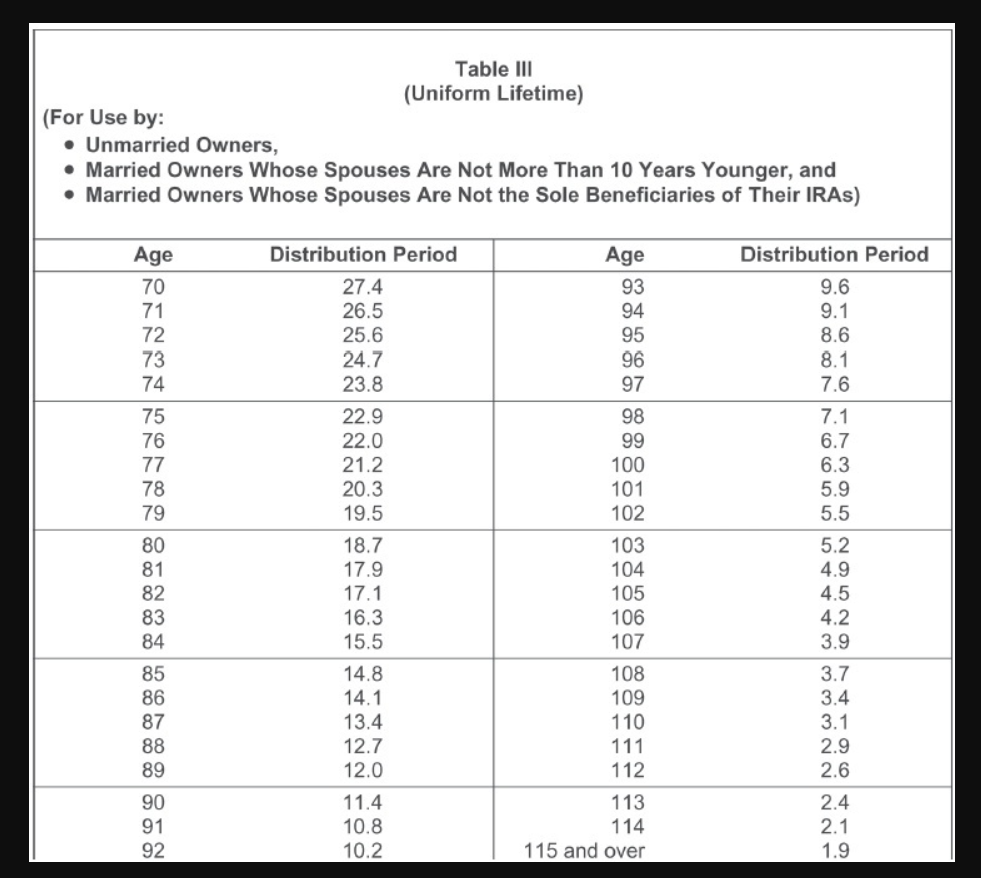

The applicable distribution period from the

Uniform Lifetime Table

Follow the instructions provided with each worksheet to calculate your RMD. You can also consult with a tax professional or financial advisor if you need assistance.

Required minimum distribution worksheets from the IRS are essential tools for retirement planning. By understanding how to use these worksheets, you can ensure you're taking the correct RMDs, avoiding penalties, and planning your retirement income and taxes more effectively. Remember to consult the IRS website or a tax professional if you have questions or need assistance with calculating your RMDs. With the right guidance, you can navigate the world of RMDs with confidence and enjoy a more secure retirement.

Note: The information provided in this article is for general purposes only and should not be considered as tax or financial advice. It's always recommended to consult with a tax professional or financial advisor for personalized guidance.

Word count: 500

Meta Description: Learn how to calculate your required minimum distributions (RMDs) using IRS worksheets and ensure you're taking the correct amount from your retirement accounts.

Keywords: Required Minimum Distributions, RMD worksheets, IRS, retirement planning, tax regulations, retirement accounts.